Innovation in the fixed index annuity (“FIA”) space has markedly improved the offering and this provides a very important distinction to bonds. We find that examples of this innovation in FIAs have outperformed bonds on a consistent basis over the last 25 years

- Both FIAs and bonds are principal protected, however bonds are exposed to yields whereas FIAs can participate in a wide range of exposures other than yields

– Yields are near historical lows, and past bond performance has been driven partly by decreasing yields

– Past bond performance might not be repeatable, and increasing yields will act as a headwind to bond performance

- FIAs offer flexible exposures to a diverse range of investments, including the latest equity smart betas and dynamic multi-asset portfolios

Introduction

FIAs represent a balance between participation in interesting equity exposures and downside protection. This balance becomes more important as retirement nears.

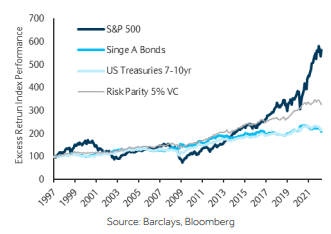

In this paper, we compare traditional investment alternatives to popular types of crediting methods found in FIA products. We simulate historical performance going back 25 years and compare performance characteristics, with respect to average returns, drawdowns and the probability of beating a simple rolling bond exposure.

We include recent innovations in the FIA space that improve performance characteristics, including multi-asset portfolios that offer higher risk adjusted returns and volatility targeted indices that allow for higher rates associated with the FIA crediting method.

Our results for the period indicate that these innovations may result in a significant improvement in performance. We find that a volatility targeted equity-bond portfolio outperformed a Single A Bond portfolio in 98% of the periods that we analysed. Finally, we consider the impact of decreasing yields on performance and the possibility of rising yields in the future.

Indices and Innovation

Since ~2013, most insurance carriers have introduced volatility controlled indices that combine equities and bonds using a version of “risk parity”. In our analysis, we consider traditional market betas, including S&P 500, US treasury bonds and single A bonds, as well as a dynamic equity-bond risk parity index with 5% volatility target, comprising S&P 500 and 7-10 year US treasury bonds. For simplicity, we did not consider smart beta style index enhancements, such as value, momentum or quality.