The BalancedChoice® Annuity helps grow and protect your retirement savings

The BalancedChoice® Annuity (BCA™) is designed to help people like you meet your retirement objectives. BCA™ offers a number of potential benefits, including:

• Growth potential — Your annuity can increase in value based in part on the performance of an underlying index.

• Downside market protection — Your premium and credited earnings are protected from downside market risk.1

• Lifetime income — Create a source of retirement income you can’t outlive with the optional BalancedAllocation Lifetime Income Rider® (BALIR®), available for additional cost at contract issue.

Adding an insurance product like a fixed indexed annuity to your retirement portfolio can be an effective way to reduce the risk and increase the potential of achieving your retirement goals.

What is a fixed indeed annuity?

A fixed indexed annuity is a contract issued by an insurance company. In exchange for your premium, the insurance company provides the opportunity for growth based in part on the performance of an underlying index while protecting your money from downside market risk. All guarantees are backed by the claims[1]paying ability of the issuing carrier and may be subject to annual fees. Other restrictions and limitations may apply. Please refer to the BCA™ product brochure and inserts for complete details.

Evaluate the potential risk of your current portfolio allocations

As Americans live longer, those planning for retirement face the possibility of living 30 years without a paycheck. Despite this possibility, only 54% of households have a formal retirement income plan.2 If you’re concerned about the possibility of outliving your retirement savings, you may want to consider reducing the retirement income shortfall risk in your retirement portfolio.

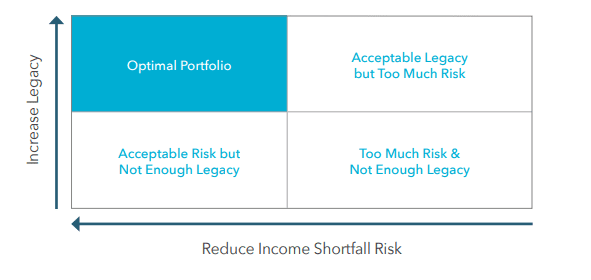

Income shortfall risk combines several important risk factors, including longevity risk (married couples have a 50% chance of one spouse living to age 933 ), sequence of returns risk (potential market losses at the beginning of retirement have a significant impact on retirement income) and inflation risk. An optimal retirement income portfolio provides a balance between increasing potential legacy and lowering income shortfall risk. The graph below illustrates the hypothetical relationship between income shortfall risk and legacy:

The optimal portfolio’s potential risk and return